Executive Summary

The feed milling industry in Bangladesh has emerged as a cornerstone of the nation’s agro-economy, serving as an indispensable backward linkage to the rapidly expanding poultry, aquaculture, and livestock sectors. This report provides an exhaustive strategic analysis of the industry, examining its market structure, operational dynamics, supply chain vulnerabilities, and future trajectory. With an estimated investment of BDT 28,000 crore and an annual production capacity nearing 8 million metric tonnes, the sector is a significant contributor to national GDP, employment, and, most critically, food and nutrition security for a population of 182 million people.

The market is characterized by a fundamental paradox: while aggregate data indicates production overcapacity, the industry is simultaneously experiencing a wave of new investment from major conglomerates. This signals a period of intense strategic consolidation, where older, inefficient mills are being displaced by technologically advanced, large-scale operations. The competitive landscape is consequently an oligopoly, with the top 25 firms controlling over 81% of the market. Dominant players like Kazi Farms Group, Paragon Group, and Quality Feeds Ltd. leverage vertical integration across the value chain—from hatcheries to contract farming—to create a formidable competitive moat, securing captive markets and enhancing resilience against market shocks.

Demand is robust, driven primarily by the commercial poultry sector, which accounts for up to 60% of feed consumption, and a burgeoning aquaculture industry where Bangladesh is a global leader. These demand drivers are underpinned by strong macroeconomic fundamentals, including rising disposable incomes and a corresponding consumer shift towards higher protein consumption. This evolution points towards a latent, high-margin opportunity for specialized and value-added feeds, such as those for export-oriented shrimp farming and high-yield dairy cattle.

However, the industry’s growth potential is tethered to its profound vulnerability: a critical dependency on imported raw materials, particularly soybean meal and maize. This reliance exposes the entire value chain to global price volatility, geopolitical supply disruptions, and foreign exchange risk. This structural weakness is exacerbated by a “sticky-down” pricing phenomenon, where the benefits of falling global commodity prices are not fully passed on to farmers, suggesting market power concentration among the largest players.

The regulatory environment is comprehensive but fragmented, with multiple agencies and laws creating complexity. A critical policy mismatch exists, where government support focuses on broad agricultural subsidies rather than addressing the industry’s specific challenge of managing imported input costs.

Looking toward 2030, the Bangladesh feed industry is at an inflection point. Its trajectory is set towards greater consolidation, driven by technological adoption and economies of scale. The future will be defined by the ability of its leading firms to mitigate supply chain risks, innovate with high-value products, and leverage their growing capacity to penetrate regional export markets. This report concludes with targeted recommendations for investors, incumbents, and policymakers to navigate the challenges and capitalize on the immense opportunities within this vital sector.

Section 1: The Feed Milling Industry in the Context of Bangladesh’s Agro-Economy

1.1. A Pillar of National Food Security and Protein Production

The feed milling industry of Bangladesh functions as a foundational pillar for the nation’s food security apparatus, acting as the most critical backward linkage for domestic protein production.1 In a densely populated country of 182 million with a 1.1% annual growth rate, satisfying the nutritional needs of the populace is a formidable and continuous challenge.3 The industry directly underpins the viability of the country’s vast livestock and aquaculture sectors, which collectively encompass a population of 44 crore animals, including cows, buffaloes, goats, sheep, and chickens, alongside a rapidly expanding fish farming industry.1 The availability of commercially produced, nutritionally balanced feed is the primary enabler for the intensive farming practices required to meet the protein demands of the country.

The strategic importance of the feed industry is magnified when viewed through the lens of public health and nutrition. Historically, Bangladesh has grappled with significant protein deficiency among its population. According to the World Health Organization (WHO), the country remains on the lower end of global protein consumption.4 For instance, the average Bangladeshi consumes an estimated 3 kg of meat annually, a figure starkly lower than neighboring India (5 kg) and Pakistan (11 kg). Similarly, per capita egg consumption, at approximately 70 per year, is nearly half that of India and a fraction of high-performing nations like Japan (1,200 per year).4 The Food and Agriculture Organization (FAO) has reported that malnutrition rates in Bangladesh are among the highest in the world, with 25% of the population considered malnourished and a significant number of children suffering from high levels of micronutrient deficiency.4 The growth of the feed industry is, therefore, intrinsically linked to the national goal of tackling these pressing health issues by making animal-based proteins—meat, eggs, milk, and fish—more affordable and accessible. Private investors, recognizing this unmet demand, have catalyzed the growth of commercial livestock, fisheries, and poultry farms, which in turn created the demand for the feed and other backward linkage industries that support them.4

The industry’s role extends beyond being a mere supplier; it is an economic and geopolitical stabilizer. By enabling robust domestic protein production, it insulates the country from the volatility of global food markets, conserves precious foreign exchange reserves that would otherwise be spent on importing finished animal products, and generates widespread rural employment. This function acts as a critical buffer against potential food price shocks and associated social instability. The logic is straightforward: Bangladesh’s rising incomes and urbanization are fueling a dietary shift towards higher protein consumption.3 Without a domestic feed industry to support local production of this protein, the nation would be forced to import massive quantities of meat, milk, and eggs, exposing it to global price fluctuations and draining its already stressed foreign currency reserves.5 The value chains sustained by the feed industry employ millions of people, further cementing its status as a strategic national asset essential for food sovereignty and economic resilience.4

1.2. Economic Contribution: GDP, Employment, and Investment

The feed milling industry is a significant economic engine within Bangladesh’s broader agricultural landscape. The agriculture sector itself is a vital component of the national economy, contributing between 15% and 20% to the country’s Gross Domestic Product (GDP) and providing employment to a substantial portion of the labor force, estimated at 43% to 47%.3 Within this large sector, the livestock and fisheries sub-sectors—the primary clients of the feed industry—have emerged as particularly dynamic growth areas. In the 2021-22 fiscal year, these sub-sectors collectively contributed 4.5% to the national GDP.5 The fisheries sector alone accounts for approximately 3.61% of GDP and a remarkable 25.30% of the total agricultural GDP, underscoring its economic weight.9

The feed industry itself represents a major concentration of capital and labor. According to the Feed Industries Association of Bangladesh (FIAB), the total investment in the sector is currently estimated at approximately BDT 28,000 crore (around USD 2.4 billion).1 This substantial investment has built an industry that provides a livelihood, either directly or indirectly, to an estimated 5 million people across the country.4 This employment impact is crucial in a country where creating jobs for a large and youthful population is a top priority. The industry’s growth, therefore, has a direct and positive effect on poverty alleviation and rural development.

1.3. The Critical Backward Linkage to Livestock and Aquaculture Growth

The modern commercial viability of Bangladesh’s protein sectors is inextricably dependent on the feed milling industry. For intensive farming operations, particularly in poultry, feed is the single largest cost component, accounting for 70-80% of total production expenses.1 This figure highlights that the availability of affordable, high-quality manufactured feed is not merely an input but the central economic determinant of success for commercial farmers. The industry’s evolution is a direct reflection of the transformation in the country’s farming practices. The pivotal shift from traditional, low-yield backyard farming to organized commercial operations was the primary catalyst for the feed industry’s establishment and subsequent boom.2 This transition was most pronounced in the poultry sector, which began to commercialize in the mid-1980s and gained significant momentum after the year 2000, creating a surge in demand that spurred major investments into feed milling by both local and international firms.2

A parallel story has unfolded in the aquaculture sector, where Bangladesh has ascended to become a global powerhouse. The country now ranks third globally in inland water fish production and fifth in overall aquaculture production.5 This remarkable growth trajectory would have been impossible without the support of a sophisticated aquafeed industry. Aquaculture production has surged from just 657,120 tonnes in 2000 to an estimated 2.8 million tonnes in 2024.11 This expansion has been fueled by the development and widespread adoption of specialized commercial aquafeeds, which have allowed farmers to intensify production and improve yields far beyond what is possible with traditional methods. The industry provides a range of products, from simple sinking pellets to advanced extruded floating feeds, tailored to the nutritional needs of key farmed species like carp, pangasius, and tilapia, which form the backbone of the country’s fish supply.5

Section 2: Market Size, Growth, and Segmentation

2.1. Market Valuation and Production Volume Analysis

The Bangladeshi animal feed market has demonstrated impressive growth in both volume and value, establishing itself as a multi-billion-dollar industry. In 2022, the market reached a production volume of 6.57 million metric tonnes (MT), which was valued at approximately US$ 3.29 billion.14 This represents a remarkable 2.4-fold increase in production volume since 2012, highlighting a decade of rapid expansion. The industry’s total installed annual production capacity is estimated to be even higher, at around 8 million MT, according to data from the Feed Industries Association of Bangladesh (FIAB).1 This suggests that the industry is currently operating with a significant capacity utilization gap of roughly 1.5 million MT, a dynamic that has profound implications for market competition and future investment.

There are some variations in the reported market size figures. While the US$ 3.29 billion valuation is cited in one market research report 14, another analysis estimates the market size to be around $2.5 billion.4 This discrepancy likely arises from different calculation methodologies, timeframes, or points of valuation (e.g., ex-factory prices versus retail market value including distribution markups). Regardless of the precise figure, both estimates confirm the industry’s substantial economic scale.

2.2. Historical Growth Trajectory and Future Projections (2025-2034)

The feed industry’s expansion has been characterized by a consistently high growth rate. Industry observers note a steady annual growth of 8-10% over the past several years.4 Some reports indicate that commercial feed production experienced a near 25% growth over the last decade, with the year 2020 witnessing a record expansion of over 26% before moderating in the post-pandemic period.2

Future projections remain highly optimistic, underpinned by the continued growth in domestic demand for animal protein. One comprehensive market forecast projects a compound annual growth rate (CAGR) of 8.70% for the Bangladesh animal feed market between 2025 and 2034.17 This sustained growth is expected to drive further expansion in production capacity, which is projected to increase from the current 8 million MT to 10 million MT by the year 2030.1 The aquaculture segment, a key driver of this growth, is independently forecast to expand at a CAGR of 3.7%, with total production volume expected to reach 4.0 million tonnes by 2033, up from 2.8 million tonnes in 2024.13

A critical paradox, however, defines the current investment climate. Despite the clear evidence of significant aggregate overcapacity, major national conglomerates, including prominent names like RFL-PRAN Group and Partex Group, are reportedly making fresh, large-scale investments to set up new feed mills.4 This seemingly contradictory behavior is not a sign of market miscalculation but rather a clear signal of a strategic consolidation phase. The existing overcapacity is likely concentrated among a large number of older, smaller, and less efficient mills, many of which have either ceased production or are operating at less than 50% capacity due to their inability to compete on price, quality, and scale.1 The new investments, in contrast, are directed toward establishing state-of-the-art, highly automated facilities that can leverage superior economies of scale and production efficiency. This dynamic represents a period of creative destruction, where inefficient capacity is being systematically replaced by technologically advanced, well-capitalized operations poised to capture the long-term value in a market with robust underlying demand growth.

Table 2.1: Bangladesh Animal Feed Market Size and Growth Forecasts (2022-2034)

| Year | Production Volume (Million MT) | Market Value (USD Billion) | Annual Growth Rate (%) | Projected CAGR (2025-2034) (%) | |

| 2022 | 6.57 | 3.29 | – | – | |

| 2023 | ~7.0 (Est.) | ~3.5 (Est.) | ~6.5% | – | |

| 2024 | ~7.5 (Est.) | ~3.8 (Est.) | ~7.0% | – | |

| 2025-2034 | Projected to grow to ~17.5 MT | Projected to grow to ~$8.8B | – | 8.70% | |

| Sources:.1 Note: Values for 2023 and 2024 are estimates based on reported growth rates. Projections for 2034 are calculated based on the 8.70% CAGR. |

2.3. Deep Dive into Market Segments: Poultry, Aquaculture, and Cattle Feed

The Bangladeshi feed market is composed of three primary segments, each with distinct characteristics and growth dynamics.

Poultry Feed: This is the undisputed dominant segment of the industry. It accounts for over 50% 4 and, by some estimates, as much as 56-60% of the total feed consumed in the country.14 The commercial poultry sector, which has largely replaced traditional backyard farming, is almost entirely dependent on manufactured feed for its operations.1 The market is well-developed, offering a range of specialized products tailored to different stages of poultry life, such as broiler starter, broiler finisher, and various types of layer feed for egg-producing hens. The pricing of these products is highly sensitive to the fluctuating costs of raw materials like corn and soybean meal, which are the primary ingredients.18

Aquaculture (Aquafeed): This is the second-largest and most rapidly growing segment of the feed market. The demand for aquafeed is directly fueled by the explosive growth of Bangladesh’s aquaculture sector. Total aquafeed production reached 1.54 million MT in 2024, a significant increase from just 890,000 MT in 2016.12 A key technological shift is occurring within this segment, with a pronounced move away from traditional farm-made feeds and simple sinking pellets towards more efficient, industrially produced extruded floating feeds. These advanced floating feeds now constitute approximately 75% of the total aquafeed market, up from 50% in 2020.12 This segment primarily serves the needs of farmers cultivating key freshwater species such as various types of carp, pangasius, and tilapia, which are central to the nation’s fish supply.5

Cattle Feed: This remains the smallest of the three major segments, consuming only about 5% of the total manufactured feed, which translates to a volume of approximately 0.67 million MT.1 However, this segment is experiencing steady growth. The key drivers are the government-supported development of a stronger indigenous dairy sector, which has been catalyzed by a decline in illegal cattle imports from India, and a growing awareness among farmers about the benefits of scientific animal husbandry and nutrition for improving milk yields and animal health.5 As farmers increasingly adopt high-yielding exotic and cross-bred cattle, the demand for formulated, high-quality cattle feed is expected to rise.

Table 2.2: Market Segmentation by Feed Type, Consumption Volume & Share (%)

| Feed Type | Consumption Volume (Million MT, 2022) | Percentage of Total Market (%) | |

| Poultry Feed | ~3.81 | ~58% | |

| Aquaculture Feed | ~1.54 (2024 data) | ~23% | |

| Cattle Feed | 0.67 | ~10% | |

| Other | ~0.55 | ~9% | |

| Total | ~6.57 | 100% | |

| Sources:.1 Note: Poultry and Other values are calculated based on the 58% share of the 6.57 million MT total. Aquafeed data is from a 2024 source. |

Section 3: Competitive Landscape and Market Structure

3.1. An Oligopolistic Framework: Market Concentration and Key Players

The feed milling industry in Bangladesh, while characterized by a high degree of surface-level competition, is structurally an oligopoly. A small number of large, well-established firms dominate the market, wielding significant influence over production, pricing, and distribution. A 2018 survey revealed that the top 15 feed mills in the country accounted for over 70% of the total market share.20 More recent data indicates that this concentration has intensified, with the top 25 firms now collectively holding a commanding 81.5% of the market.1

This high concentration of market power provides the dominant players with substantial competitive advantages. They benefit from superior economies of scale in raw material procurement, greater efficiency in their large-scale production facilities, and considerable pricing power in the marketplace. This makes it exceedingly difficult for the numerous smaller mills to compete effectively. Consequently, while official data from 2020-21 indicates the presence of 249 registered and 83 unregistered feed mills, a large portion of these are either inactive or operating at significantly reduced capacities, unable to withstand the competitive pressures exerted by the industry giants.1 Geographically, the Dhaka division hosts the highest concentration of active registered feed mills, reflecting its status as a central economic hub.20 The market dynamic has pushed many small and medium-sized companies towards closure, as they are unable to remain competitive in a volume-driven business where margins are tight and capital investment requirements are high.1

3.2. Profiles of Major Industry Players

The leadership of the Bangladeshi feed industry is comprised of a mix of powerful local conglomerates and major international players.

- Kazi Farms Group: A premier, fully integrated local company that is consistently ranked among the top feed producers.2 The group made substantial investments in the sector after the year 2000, aligning with the boom in commercial poultry, and is a dominant force in the market.2

- Paragon Group: A leading brand in the national feed market since its entry in 1996, Paragon is one of the largest agro-based industries in the country by operational scale and customer base.21 The group operates an extensive network of 16 production lines across six strategic locations, including Gazipur, Savar, Jessore, and Chattogram. Its product portfolio is one of the most diverse, covering not only standard poultry, fish, and cattle feed but also specialized feeds for shrimp, duck, and quail.2

- Quality Feeds Ltd. (QFL): Established in 1995, QFL is a pioneering force in the industry, particularly recognized for its leadership in fish and shrimp feed production.22 The company operates 19 independent plants in Gazipur and Bogura with a combined installed capacity of 550,000 MT per annum. QFL is distinguished by its vast distribution network, which includes 29 regional offices and 24 depots, and its strong emphasis on quality control, supported by 10 poultry disease diagnosis labs and 2 aqua labs.22

- CP Bangladesh: A subsidiary of the Thai multinational giant Charoen Pokphand Group, CP Bangladesh is a major international force in the market. The company made a significant entry with a $60 million investment and has become a key competitor in both the poultry and aquafeed segments.2 In addition to feed, the company is also a key supplier of high-quality tilapia fry, demonstrating a degree of vertical integration.12

- Nourish Poultry & Hatchery Ltd.: A prominent local company frequently listed among the top producers in Bangladesh, with a strong presence in the poultry feed market.1

- Aftab Bahumukhi Farms Ltd. / ACI Godrej Agrovet Pvt. Ltd.: These entities, often mentioned together or separately, are key players in the industry. Aftab is a well-established local name, while ACI Godrej is a joint venture that brings international expertise to the market. Both are consistently ranked among the leading companies.2

- New Hope Feed Mill Bangladesh Ltd.: A key international player from China, New Hope has established a strong market presence and is particularly noted for its growing influence in the aquafeed segment, where it competes on quality against local and other international brands.12

Other significant companies contributing to the market’s competitive fabric include Provita Group, National Feed Mills Ltd., and Desh Feed Mills Ltd..2

The dominance of these large players is not merely a function of their scale in feed milling but is powerfully reinforced by their strategy of vertical integration. Companies like Kazi Farms and Paragon Group are not just feed producers; they are integrated conglomerates with operations spanning the entire protein value chain, including hatcheries, contract farming schemes with smallholders, and processing facilities. This integration creates a formidable competitive moat. It provides a secure, captive market for their own feed production, insulating them from the fierce competition in the open market where standalone mills must fight for every customer. Furthermore, this model gives them superior control over their input costs and the quality of their final products, while also providing greater resilience against market volatility. The success of smallholder farmers participating in contract farming schemes is directly tied to the integrator, who supplies inputs like feed and guarantees offtake of the final product.25 This closed-loop system solidifies the market power of the integrators and presents a significant barrier to entry for new players hoping to compete as standalone feed mills. The market structure is therefore not just an oligopoly, but an

integrated oligopoly, where success is increasingly defined by control over the entire protein production pipeline, not just milling efficiency.

Table 3.1: Top Feed Mill Companies in Bangladesh by Estimated Market Share and Capacity

| Company Name | Country of Origin | Key Product Segments | Estimated Annual Capacity (MT) | Estimated Market Share (%) | |

| Kazi Farms Group | Local | Poultry, Fish | High | >10% | |

| Paragon Group | Local | Poultry, Fish, Cattle, Shrimp, Duck, Quail | High | ~15% | |

| Quality Feeds Ltd. (QFL) | Local | Fish, Shrimp, Poultry, Cattle | 550,000 | High | |

| Aftab Bahumukhi Farms Ltd. | Local | Poultry, Fish | High | ~25% | |

| Nourish Poultry & Hatchery | Local | Poultry, Fish, Cattle | High | High | |

| CP Bangladesh | International (Thailand) | Poultry, Fish, Shrimp | High | High | |

| New Hope Feed Mill | International (China) | Poultry, Fish | High | ~12% | |

| ACI Godrej Agrovet Pvt. Ltd. | Joint Venture | Poultry, Cattle | High | ~18% | |

| Provita Group | Local | Poultry, Fish | Medium-High | Medium | |

| National Feed Mills Ltd. | Local | Poultry, Fish | ~60,000 | Medium | |

| Sources:.1 Note: Market share percentages are based on various reports and may be estimates. Capacity figures are provided where available. |

3.3. The Role and Influence of Industry Associations

The collective interests of the feed milling industry are represented by two key trade bodies that play crucial roles in advocacy, standard-setting, and market development.

Feed Industries Association of Bangladesh (FIAB): Established in 2008, FIAB is the principal and sole representative body for manufacturers of poultry, aqua, and cattle feed in the country.26 As a registered not-for-profit business association and a member of the influential Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), FIAB serves as the industry’s official voice in engagements with the government, including the Ministry of Commerce.27 The association’s mandate is extensive, covering a wide range of activities designed to protect and promote the sector. These include watching over the general trading interests of its members, fostering responsible and safe production practices, promoting or opposing legislation that affects the trade, collecting and circulating vital industry statistics, and mediating controversies among its members.26 FIAB has been particularly active in lobbying the government on critical policy issues, such as challenging the mandatory use of jute sacks for feed packaging, which it argues is impractical and costly, and advocating for the introduction of cash incentives on feed exports to enhance global competitiveness.27

Bangladesh Agro Feed Ingredients Importers & Traders Association (BAFIITA): This association represents a different but equally critical segment of the value chain: the importers and traders of feed ingredients, additives, and supplements.30 BAFIITA claims that its members are responsible for supplying over 50% of the country’s total requirement for these essential raw materials. Its existence and influence underscore the industry’s heavy reliance on imports and the importance of the trading houses that facilitate this international supply chain. BAFIITA works for the welfare of its members and contributes to the development of the broader animal production industry by ensuring a steady supply of quality ingredients.30

Section 4: Analysis of Demand Drivers

4.1. The Poultry Sector Engine: Commercial Farming and Feed Consumption

The poultry industry stands as the primary engine of demand for the feed milling sector in Bangladesh. The industry has been expanding at a remarkable rate, with annual growth estimated between 15% and 20%.3 This rapid expansion has resulted in a massive production output, currently estimated at 1.46 million tons of poultry meat and 23.37 billion eggs annually.25 This scale of production is fundamentally reliant on the feed industry. The structural shift from traditional, small-scale backyard chicken rearing to organized, intensive commercial farming has made the sector almost completely dependent on industrially manufactured feed.2

The demand within the poultry sector is not just for quantity but increasingly for quality. As consumers become more discerning and seek higher-quality meat and eggs, farmers are compelled to invest in superior feed.18 There is a growing recognition among poultry producers that better feed formulations lead directly to healthier birds, improved feed conversion ratios (FCR), and ultimately, higher financial returns. This trend is driving a continuous demand for more sophisticated and nutritionally optimized poultry feeds, creating a virtuous cycle of quality improvement throughout the value chain.

4.2. The Expanding Aquaculture Frontier: Species, Systems, and Aquafeed Dynamics

Aquaculture represents the second major pillar of demand for the feed industry and is a frontier of significant growth. Bangladesh has established itself as a global aquaculture powerhouse, with total production from fish farming reaching 2.8 million MT in 2024.13 The government has set an ambitious target to increase total fish production to 8.4 million tons by 2041, and since capture fisheries are not expected to grow, this entire increase will need to come from aquaculture.12 This long-term national goal guarantees a sustained and growing demand for aquafeed for decades to come.

The growth in aquaculture has been driven by the successful farming of key freshwater species, which account for about 90% of the total aquaculture production.12 These include various types of carp, pangasius, and tilapia, which are staple food items for the population.5 The demand for feed in this segment has also evolved technologically. The market has progressed from rudimentary farm-made feeds and simple sinking pellets in the 1990s and 2000s to a market now dominated by commercially produced, extruded floating feeds.12 These advanced feeds offer better water stability, higher digestibility, and reduced waste, leading to improved farming efficiency.

A particularly high-value sub-segment is shrimp farming. While Bangladesh has a long history of farming native shrimp species like Bagda (Penaeus monodon) and Golda (freshwater prawn), the recent government approval for farming Litopenaeus vannamei (whiteleg shrimp) presents a major opportunity for an export-oriented boom.12 However, the local production of specialized, high-quality shrimp feed remains a nascent and underdeveloped area. Most shrimp feed is currently imported, primarily from India, indicating a significant and lucrative market gap for domestic producers who can master the technology and quality requirements for this demanding segment.12

4.3. Evolving Consumer Palates: The Impact of Rising Incomes on Meat, Fish, and Egg Consumption

Underlying the explosive growth in the poultry and aquaculture sectors is a fundamental and powerful macroeconomic driver: a profound shift in consumer behavior fueled by sustained economic development. Bangladesh’s consistent GDP growth has led to a steady rise in per capita income, which reached $1,751 in fiscal year 2017-18 from $1,610 the previous year.3 This increase in prosperity directly translates to higher disposable income, a significant portion of which is being spent on improving dietary quality, particularly through increased consumption of protein-rich foods.

The data clearly illustrates this dietary transition. Between 2016 and 2022 alone, per capita meat consumption in Bangladesh surged by an impressive 57%, while milk consumption rose by 25%.5 The consumption of eggs, a key and affordable protein source, more than doubled between 2010 and 2016, from 7.20g per day to 13.58g per day.3 Chicken is the most popular and widely consumed meat, valued for its affordability and cultural acceptance across all demographic groups, followed closely by fish, which remains a cornerstone of the national diet.6 While the consumption of red meat is also on the rise, chicken and fish form the core of animal protein intake for the majority of the population.6

Furthermore, as consumers become more affluent and health-conscious, there is an emerging demand for not just more protein, but safer and higher-quality protein. A recent study using experimental auctions found that Bangladeshi consumers were willing to pay a significant premium—ranging from 21% to 52%—for fish that was certified as safer, with lower levels of contaminants like bacteria and heavy metals.33 This trend indicates a latent, future demand for feed that can guarantee these desirable attributes in the final product, opening up possibilities for “functional feeds” that can command a premium price.

This confluence of factors points to a significant, yet largely untapped, market for specialized and value-added feed products. While the current market is dominated by the high-volume production of standard poultry and carp feed, the emergence of niche, high-value segments signals a clear opportunity for diversification and margin enhancement. The government’s approval of Vannamei shrimp farming, a high-value export commodity, has created an immediate demand for specialized shrimp feed, a market currently underserved by local producers who lack the necessary technology and risk appetite.12 Similarly, the growth of the dairy sector, with its increasing adoption of high-yielding exotic breeds, necessitates the development of scientifically formulated, high-performance dairy feeds that go far beyond basic cattle feed formulations.5 Finally, the demonstrated consumer willingness to pay more for “safer” fish creates a potential market for “functional” aquafeeds that are certified free from contaminants and may contain additives that improve fish health and flesh quality.33 The feed companies that can successfully develop, produce, and market these specialized, high-performance products will be able to capture significantly higher margins and establish a strong competitive advantage over those focused solely on commodity feed production.

Section 5: Raw Material Supply Chain: The Industry’s Lifeline and Vulnerability

5.1. The Primacy of Corn and Soy: Sourcing and Domestic Production

The economic viability and cost structure of the entire Bangladeshi feed industry are overwhelmingly dictated by two primary raw materials: maize (corn) and soybean meal. These two ingredients form the backbone of most feed formulations, with maize typically constituting around 55% of the mix and soybean meal, the primary protein source, making up about 30%.1 The sourcing and pricing of these two commodities represent the industry’s most critical operational challenge.

Maize (Corn): The industry’s annual demand for maize is substantial, estimated to be between 6.5 and 7.0 million MT.1 In a significant agricultural success story, Bangladesh has managed to dramatically increase its domestic corn production, which now stands at an impressive 5.4 million MT.1 This local production meets approximately 80% of the total demand from the feed industry. The remaining 20%, amounting to 2.0 to 2.4 million MT annually, must be covered by imports.1

Soybean: The situation with soybean is far more precarious, representing the industry’s single greatest point of vulnerability. The dependency on foreign sources for this crucial protein ingredient is extremely high. It is estimated that between 80% and 90% of the country’s total soybean and soybean meal requirement is met through imports.1 With an expected annual consumption of 2.65 million tonnes of soybean meal, this translates into a massive import bill and a significant reliance on the global supply chain.1 Local production, concentrated mainly in the Laximpur region, can only satisfy a small fraction (10-20%) of this demand.1

In addition to these two primary ingredients, the industry also relies on imports for a host of other essential materials, including protein sources like rapeseed and meat and bone meal (MBM), as well as critical micronutrients, vitamins, and pre-mixed additives that are vital for creating nutritionally complete feeds.1

5.2. The Import Dependency Dilemma: Global Sourcing, Forex Exposure, and Geopolitical Risks

The industry’s heavy reliance on imported raw materials creates a complex web of risks that directly impact its stability and profitability. This dependency makes the entire sector acutely vulnerable to a range of external shocks, including global commodity market volatility, logistical and supply chain disruptions (as starkly demonstrated during the COVID-19 pandemic and the Russia-Ukraine war), and, critically, foreign exchange rate fluctuations.2

Geographically, India serves as a primary source for many imported raw materials, especially corn, where it holds a 78% share of Bangladesh’s import market.1 This reliance on a single large neighbor is a double-edged sword. While proximity offers advantages in terms of lower transportation costs and shorter shipment times, it also exposes Bangladesh to significant geopolitical risk. Any supply issues within India, such as a poor harvest or the imposition of export bans to protect its own domestic market (as has occurred with wheat), can have an immediate and severe impact on the availability and price of raw materials for Bangladeshi feed mills.1 Brazil is the other major supplier of corn, providing a degree of diversification but involving much longer and more expensive supply chains.1

The financial risk is equally pronounced. The depreciation of the Bangladeshi Taka (BDT) against the US dollar—the currency in which most international commodities are traded—directly and immediately inflates the cost of imported raw materials. This currency exposure is a major challenge frequently cited by industry leaders as a key pressure point on their profitability and a significant driver of domestic feed price inflation.2

5.3. Anatomy of Cost: Price Volatility, Seasonality, and Impact on Profitability

Price volatility of raw materials is the single greatest and most persistent challenge facing the feed industry. The fluctuations can be extreme. For example, the price of maize skyrocketed from BDT 17.30 per kilogram in July 2020 to BDT 36 per kilogram in November 2023. Over a similar period, the price of soybean meal, a critical protein source, surged from BDT 38 per kg to as high as BDT 84 per kg before settling around BDT 62.5 per kg in early 2024.1 This extreme volatility makes cost control and financial planning incredibly difficult for feed manufacturers.

A particularly telling dynamic is the phenomenon of “sticky-down” pricing observed in the local market. Despite significant drops in global commodity prices at various times, domestic feed prices in Bangladesh have often remained stubbornly high, declining only marginally, if at all.19 For instance, when the international price of soybean meal fell from $422 per tonne to $376 per tonne, the corresponding drop in the local market was a mere BDT 1 to 1.5 per kilogram.19 This disconnect suggests a structural inefficiency in the market. In a highly competitive environment, a sharp fall in a primary input cost would typically force producers to lower their prices to attract customers. The absence of this price correction strongly implies that the dominant oligopolistic players possess enough market power to absorb these cost savings as increased profit margins rather than passing them on to the farmers. This practice exacerbates the financial struggles of smallholder farmers, who bear the brunt of high feed costs, and reinforces the market power of the large, integrated players who can better manage input cost volatility.19

This volatility at the raw material level inevitably translates into unstable prices for the final agricultural products. The fluctuating cost of feed is a direct cause of the volatile prices for chicken, eggs, and fish that consumers face in the market, creating uncertainty for both producers and consumers and complicating efforts to manage national food inflation.2

Table 5.1: Key Raw Material Sourcing, Domestic vs. Import Share, and Price Trends (Maize & Soybean Meal)

| Raw Material | Annual Demand (MT) | Domestic Production (MT) | Import Volume (MT) | Import Dependency (%) | Key Import Source Countries | Average Price Trend (BDT/kg) | |

| Maize (Corn) | 6.5 – 7.0 million | 5.4 million | 2.0 – 2.4 million | ~20% | India (78%), Brazil (21%) | 2020: 17.30 -> 2023: 36.00 | |

| Soybean Meal | ~2.65 million | Low (meets 10-20% of demand) | High (meets 80-90% of demand) | ~80-90% | Brazil, USA, Argentina | 2020: 38.00 -> 2024: 62.50 | |

| Sources:.1 Note: Data is compiled from multiple sources and represents the most recent available figures. |

Section 6: Technological, Operational, and Quality Assurance Framework

6.1. The Modern Feed Milling Process: From Grinding to Pelleting and Extrusion

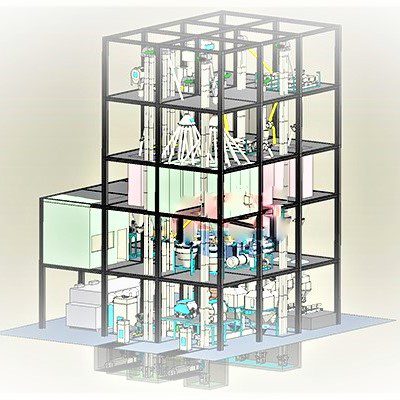

The operational core of the Bangladeshi feed industry, particularly among its leading players, is a sophisticated manufacturing process designed to convert raw agricultural commodities into precisely formulated, nutritionally complete animal feeds. The process in a modern mill follows a standardized, multi-stage workflow to ensure quality, digestibility, and safety.1

The process begins with Raw Material Selection and Storage, where quality-standard ingredients like maize, soybean meal, and various supplements are procured and stored in controlled environments, such as silos or warehouses, to prevent spoilage and contamination. The next step is Grinding, where hammer mills or roller mills are used to reduce the particle size of the grains. This increases the surface area, which is crucial for improving digestibility and ensuring a uniform blend in the subsequent mixing stage. This is followed by Mixing, where the ground materials are combined with a carefully calculated mix of supplements—including vitamins, minerals, enzymes, and other additives—in large industrial mixers to achieve a perfectly homogeneous batch.

For pelleted feed, the mixture then undergoes Conditioning, where steam and water are injected to soften the mash. This process gelatinizes starches, which improves pellet quality and durability, enhances digestibility, and helps to kill potential pathogens. The conditioned mash is then forced through a die in a Pelleting mill to form dense, durable pellets. After pelleting, the hot and moist pellets are sent to a Cooler, where forced air removes excess heat and moisture, making them stable for storage and preventing mold growth. The cooled pellets are then passed through a Screening process to separate properly formed pellets from fine particles or oversized chunks. These “fines” are typically recycled back into the production line to minimize waste. Finally, the finished feed is weighed and packaged in branded bags or loaded into bulk containers for distribution, with labels providing essential nutritional information and usage instructions.1

For the rapidly growing aquafeed market, many advanced mills employ an additional specialized process called Extrusion. This involves cooking the feed mixture at high temperatures and pressures before forcing it through a die. This process allows for precise control over the density of the final product, enabling the creation of both sinking and, more importantly, floating pellets, which are highly desirable for many aquaculture systems.1

6.2. Technology Adoption and Automation in Bangladeshi Mills

The Bangladeshi feed industry is characterized by a notable “hi-tech” approach, especially among the market leaders who have invested heavily in modernizing their production facilities.28 A significant portion of the advanced machinery and process technology is imported from globally recognized suppliers in Europe, such as Van Aarsen (Netherlands) and Skiold (Denmark), and the USA, including CPM and Sterling Systems & Controls. Technology from China is also utilized, often providing a more cost-effective alternative.24

Automation is a key trend that is transforming the industry’s efficiency and quality control capabilities. Local engineering firms like Alphatek Engineering Limited are playing a crucial role in this transition by providing sophisticated automation solutions tailored to the Bangladeshi market. These services include the implementation of fully automated control systems for entire feed mills, silo automation for efficient raw material handling, computerized and automated dosing systems for precise ingredient mixing, SCADA (Supervisory Control and Data Acquisition) systems for centralized monitoring and control, and automated bagging machines.37 These automation solutions not only improve production efficiency and reduce labor costs but also enhance product consistency and enable full traceability from raw material intake to finished product, which is critical for quality assurance.

Looking ahead, the industry is on the cusp of adopting even more advanced technologies that are becoming standard in developed markets. These include the use of Near-Infrared (NIR) spectroscopy for real-time analysis of raw materials and finished feed, which allows for rapid adjustments to formulations without lengthy lab tests. The integration of Artificial Intelligence (AI) and machine learning into process control systems to optimize energy use and predict maintenance needs is also on the horizon. The concept of fully automated “lights-out” manufacturing, where human intervention is minimal, represents the next frontier for Bangladesh’s most ambitious and well-capitalized feed mills.38

This significant capital investment required for modern, automated machinery from Europe and the US is a primary driver of market bifurcation. It is creating a two-tiered industry structure. At the top is a group of technologically advanced, highly efficient, large-scale producers who can afford the multi-million-dollar investment in state-of-the-art equipment. At the bottom is a long tail of smaller, older mills that are unable to make such investments and are left to compete with less efficient technology, resulting in higher production costs and often inconsistent product quality.1 In a market defined by volatile input costs, this efficiency gap, driven by technology, becomes a critical determinant of survival, accelerating the consolidation of the market in favor of the larger, more advanced players.

6.3. Quality Control: The Role of In-House Labs and National Standards

Quality assurance has become a key competitive differentiator for the leading feed manufacturers in Bangladesh. Recognizing that feed quality directly impacts farmer profitability and food safety, almost all large feed mills have established and operate their own sophisticated in-house laboratories.26 These labs form the first line of defense in the quality control process. They are tasked with testing every single batch of raw ingredients—whether sourced locally or imported—before they are accepted into the production process. An ingredient is not allowed to be used unless it receives an “OK” certificate from the lab.28

These laboratories are equipped to perform a range of crucial tests. This includes proximate analysis to verify the nutritional content of ingredients and finished feeds, measuring levels of crude protein, fat, fiber, and moisture.1 Critically, they also test for the presence of harmful contaminants that can compromise animal health and food safety. This includes screening for mycotoxins, such as aflatoxin, which is a major concern in grain storage, as well as testing for heavy metals and other potential toxins.1

This rigorous in-house quality control is complemented by a national regulatory framework of standards developed and enforced by government bodies. The Bangladesh Standards and Testing Institution (BSTI) is the national standards body responsible for formulating, publishing, and certifying product standards across all industries, including animal feed.18 Key standards relevant to the sector include BDS 233, which provides detailed specifications for poultry feed, and BDS 1915 for fish feed.41 BSTI works to harmonize these national standards with international benchmarks, such as those set by the Codex Alimentarius Commission and the International Organization for Standardization (ISO), to ensure that Bangladeshi products meet globally accepted quality and safety levels.40

Section 7: The Regulatory, Policy, and Fiscal Environment

7.1. Navigating the Legal Framework: Food Safety Act, Animal Feed Rules, and Import Policies

The feed milling industry in Bangladesh operates within a multi-layered legal and regulatory framework designed to govern everything from production and licensing to food safety and international trade. Several key pieces of legislation form the pillars of this framework:

- The Fish Feed and Animal Feed Act, 2010: This is the foundational law specifically tailored to the feed sector. It establishes the legal basis for regulating the production, quality, and marketing of all animal and fish feed in the country.44

- The Animal Feed Rules, 2013: Acting as the detailed implementation guide for the 2010 Act, these rules provide specific, actionable regulations for the industry. They outline the conditions and procedures for obtaining licenses for feed production, import, export, and marketing. The rules establish three categories of licenses and specify the forms and fees required. Critically, they also detail the procedures for quality control, including methods for sample collection by authorized officers, laboratory testing protocols, and the definition of “ideal levels” for key nutrients like protein, moisture, and fat. The rules also list approved food ingredients and additives in detailed schedules.39

- The Food Safety Act, 2013: This is a broad, overarching law with significant implications for the feed industry as part of the “farm to fork” food production chain. The Act established the Bangladesh Food Safety Authority (BFSA) as the central coordinating body for all matters related to food safety. Its mandate covers the regulation of food additives, contaminants, toxins, and harmful residues (such as pesticides and veterinary drugs) in the food supply, which directly relates to the quality and safety of the feed given to food-producing animals.40

- Import Policy Orders: The import of essential raw materials is governed by the prevailing Import Policy Order, such as the Order for 2021-2024. This policy sets the terms, conditions, and tariffs for bringing goods into the country and is a critical piece of regulation for an industry so heavily dependent on imported ingredients.44

7.2. The Role of Regulatory Bodies: BFSA, BSTI, and the Department of Livestock Services (DLS)

The enforcement and oversight of this legal framework are distributed among several key government agencies, each with a specific mandate:

- Department of Livestock Services (DLS): Under the Ministry of Fisheries and Livestock, the DLS serves as the primary licensing authority for the feed industry as stipulated by the Animal Feed Rules, 2013. It is responsible for issuing, suspending, or canceling licenses for feed producers, importers, exporters, and marketers. The DLS also plays a direct role in overseeing quality control measures within the industry.39

- Bangladesh Food Safety Authority (BFSA): Established as an independent agency under the Ministry of Food, the BFSA acts as the lead regulator and coordinator for all food safety matters. Its role is to ensure a scientific and coordinated approach to regulating the entire food chain, from production to consumption. For the feed industry, the BFSA’s work in setting permissible limits for contaminants, toxins, and residues is of paramount importance.40

- Bangladesh Standards and Testing Institution (BSTI): As the national standards body of Bangladesh, BSTI is responsible for formulating, adopting, and certifying product quality standards. It has developed specific Bangladesh Standards (BDS) for various types of animal feed, such as BDS 233 for poultry feed and BDS 1915 for fish feed.41 BSTI’s certification mark is a key indicator of product quality in the domestic market. The institution aims to align its standards with international benchmarks like Codex and ISO to facilitate trade and ensure consumer protection.40

While this framework appears comprehensive on paper, its implementation is often described as weak and fragmented. The involvement of multiple laws and numerous agencies (DLS, BFSA, BSTI, Ministry of Commerce, etc.) can create overlapping jurisdictions and complexity in application and enforcement, posing a challenge for businesses navigating the regulatory environment.46 This fragmentation can lead to inconsistencies and a lack of a unified, streamlined approach to industry oversight.

7.3. Impact of Government Subsidies and Industry Incentives

The government of Bangladesh provides significant fiscal support to the broader agriculture sector, which indirectly benefits the feed industry. A key example is the substantial subsidy allocated for fertilizers and other agricultural inputs. In the proposed national budget for the 2025-26 fiscal year, an allocation of Taka 17,000 crore was proposed for this purpose.48 By lowering the cost of domestic grain production, these subsidies can help to moderate the price of locally sourced raw materials like maize. Additionally, the government has provided direct cash incentives and assistance programs to farmers in the livestock and fisheries sectors, particularly to help them recover from economic shocks such as the COVID-19 pandemic.49

However, from the perspective of the feed milling industry itself, there is a perceived lack of direct and targeted support that addresses its unique challenges. The industry’s primary cost pressure comes not from domestic inputs like fertilizer, but from the high cost of imported raw materials, which is driven by global prices, import duties, and currency fluctuations. Recognizing this, the Feed Industries Association of Bangladesh (FIAB) has been actively lobbying the government for a cash incentive on the export of animal feed. FIAB argues that such an incentive is necessary to offset the high cost of imported raw materials and make Bangladeshi feed products more price-competitive in the regional and global markets, thereby helping the industry to utilize its excess production capacity and earn valuable foreign currency.29

This situation reveals a critical policy mismatch. The government’s primary fiscal support mechanisms for agriculture are broad-based and aimed at crop farmers. They do not, however, directly address the most significant economic vulnerability of the feed industry: its exposure to the costs and risks of the international commodity market. This policy gap directly constrains the industry’s ability to achieve domestic price stability and realize its full export potential.

Table 7.1: Summary of Key Regulations and Governing Bodies for the Feed Industry

| Regulation/Act | Key Provisions | Primary Governing Body | Role of the Body | |

| Fish & Animal Act 2010 | Foundational law for regulating feed production, quality, and marketing. | Ministry of Fisheries and Livestock | Provides the legal basis for sector regulation. | |

| Animal Feed Rules 2013 | Licensing, quality standards, ingredient approval, sampling, testing protocols. | Department of Livestock Services (DLS) | Issues licenses, oversees quality control, enforces rules. | |

| Food Safety Act 2013 | Regulates contaminants, toxins, residues, additives; farm-to-fork safety. | Bangladesh Food Safety Authority (BFSA) | Lead agency for food safety; sets permissible limits, coordinates all agencies. | |

| BSTI Ordinance & Acts | Formulation and certification of national product standards (BDS). | Bangladesh Standards and Testing Institution (BSTI) | Sets and certifies feed quality standards (e.g., BDS 233, BDS 1915). | |

| Import Policy Order | Governs terms, conditions, and tariffs for imported goods. | Ministry of Commerce | Regulates the import of essential raw materials for the feed industry. | |

| Sources:.39 |

Section 8: Strategic Analysis: Challenges, Opportunities, and Future Outlook

8.1. Navigating Key Industry Headwinds

The Bangladesh feed milling industry, despite its impressive growth, operates in a challenging environment defined by several significant strategic headwinds. These challenges test the resilience and profitability of all players, from the largest conglomerates to the smallest mills.

- Raw Material Volatility and Import Dependency: This is the foremost and most acute challenge confronting the sector. The heavy reliance on imported soybean meal, maize, and other additives exposes the industry to the full force of global commodity price shocks, unpredictable supply chain disruptions, and adverse movements in the foreign exchange rate. This vulnerability translates directly into an unstable cost base, making financial planning and margin management exceptionally difficult.1

- Oligopolistic Market Structure and Intense Competition: The industry is defined by the paradox of having both significant overcapacity and a highly concentrated, oligopolistic structure. This creates a fiercely competitive environment where large, integrated players with superior economies of scale can exert immense pressure on smaller, non-integrated mills, squeezing their margins and driving many out of business.1

- Macroeconomic Pressures: The broader economic climate in Bangladesh poses additional challenges. Persistently high domestic inflation increases operational costs across the board, from labor to energy and transportation. Rising interest rates make it more expensive to finance the large capital expenditures required for modernizing mills and to manage working capital needs.1

- Working Capital and Extended Credit Cycles: The industry’s business model is characterized by a long cash conversion cycle, often ranging from 120 to 150 days.1 This is due to the common practice of offering extended credit periods to dealers and farmers to facilitate sales. While this practice helps to move product, it places a significant strain on the cash flow of feed manufacturers, tying up large amounts of working capital.1

- Climate and Biosecurity Risks: The industry faces risks from both the supply and demand sides. On the supply side, climate change can adversely affect crop yields of key raw materials, both domestically and in source countries, leading to price spikes. On the demand side, outbreaks of animal diseases, such as avian influenza (bird flu) in the poultry sector, can lead to mass culling and a sudden, sharp depression in the demand for feed, creating inventory and sales crises.1

8.2. Unlocking Growth Opportunities

Amidst these challenges, the industry is also presented with a range of compelling growth opportunities that could shape its future trajectory and enhance its profitability.

- Significant Export Potential: The industry’s substantial production capacity, which currently exceeds domestic demand, presents a clear opportunity for export-led growth. Neighboring countries in South Asia, such as Nepal, Bhutan, and parts of India, represent natural and accessible export markets for Bangladeshi feed.29 Bangladesh’s strategic geographical location can be leveraged to become a regional hub for feed manufacturing and trade.50 Projections indicate that animal feed exports could grow steadily, reaching approximately 881,000 kilograms by 2028.51 Realizing this potential, however, will depend on achieving price competitiveness, which is currently hampered by high raw material costs.

- Diversification into Value-Added and Specialized Products: A major strategic opportunity lies in moving up the value chain from high-volume, low-margin commodity feeds to specialized, high-performance products. As analyzed previously, there are emerging, underserved market niches with significant growth potential. These include developing high-quality feeds for the export-oriented Vannamei shrimp industry, formulating high-performance rations for the growing high-yield dairy cattle sector, and creating “functional” aquafeeds that can produce certified-safe fish for which health-conscious consumers are willing to pay a premium. Capturing these segments would allow manufacturers to command higher prices and achieve better profit margins.

- Improving Efficiency and Embracing Sustainability: There is considerable scope for improving operational efficiency and reducing costs. Investing in more energy-efficient milling technology, adopting alternative energy sources like solar power to reduce reliance on the grid, and exploring circular economy practices—such as developing technologies to upcycle food waste into safe feed ingredients—can simultaneously lower the cost of production and meet the growing global demand for sustainable and environmentally friendly business practices.1

- Forward Integration: For feed millers, integrating forward in the value chain offers a powerful strategic advantage. By moving into areas like contract farming with smallholders or establishing their own poultry and fish processing facilities, millers can secure a guaranteed, captive market for their feed, gain greater control over the quality of the final product, and capture a larger share of the total value created in the protein supply chain.1

8.3. Concluding Insights and Industry Trajectory to 2030

The feed milling industry in Bangladesh stands at a critical inflection point. Its future path will be shaped by the interplay of its immense growth potential and its profound structural vulnerabilities. The trajectory is clearly towards greater consolidation. The future of the industry will belong to a smaller number of large, well-capitalized, and technologically advanced players. These will be the firms that can effectively manage complex international supply chain risks, achieve superior economies of scale, and innovate with a diversified portfolio of products.

The underlying fundamentals for domestic demand growth are exceptionally strong and virtually assured, driven by population growth, rising incomes, and the ongoing dietary shift towards protein. However, the industry’s profitability and long-term stability will hinge on its collective ability to mitigate its core vulnerability: the overwhelming reliance on imported raw materials.

The trajectory to 2030 will see the leading firms transform from being purely domestic support industries into sophisticated, regionally competitive agro-industrial players. This will involve a strategic pivot from a focus on domestic volume to a more balanced approach that includes high-value domestic niches and a concerted push into export markets. The ability to navigate the complex policy environment and advocate for targeted government support will be crucial in accelerating this transformation.

Section 9: Recommendations for Stakeholders

9.1. For Investors and New Entrants

- Prioritize Scale and Technology: The analysis clearly shows that the market is consolidating around large, efficient players. A small-scale, low-technology market entry strategy is highly unlikely to be viable. Any new investment should be aimed at establishing a state-of-the-art facility with significant production capacity to achieve competitive economies of scale from the outset.

- Adopt an Integrated Business Model: Rather than establishing a standalone feed mill, investors should strongly consider an integrated model that encompasses other parts of the value chain, such as hatcheries, contract farming schemes, and/or processing facilities. This provides a captive market for feed, de-risks the investment, and captures higher overall margins.

- Target High-Margin Niche Segments: While the poultry feed market is the largest, it is also the most competitive. New entrants could find a more profitable foothold by focusing on emerging, high-value niche segments where local production is currently underdeveloped. These include specialized feeds for Vannamei shrimp, high-performance dairy cattle, and functional aquafeeds for producing certified-safe fish.

- Develop Robust Risk Management Strategies: Given the industry’s acute exposure to raw material price volatility and foreign exchange risk, a sophisticated risk management strategy is not optional, but essential. This must include robust procurement strategies, potential hedging mechanisms, and rigorous financial planning to manage currency fluctuations.

9.2. For Industry Incumbents

- Continuous Investment in Efficiency: Existing players must continuously invest in upgrading their technology to improve production efficiency, reduce energy consumption, and lower their per-unit cost of production. This is critical for maintaining competitiveness against new, state-of-the-art mills entering the market.

- Product Portfolio Diversification: Incumbents should actively seek to diversify their product portfolios beyond standard commodity feeds. Investing in R&D to develop and market value-added and specialized products for the niche segments identified above will be key to improving profitability and defending market share.

- Explore Backward Integration: To mitigate the risks associated with imported raw materials, large players should explore opportunities for backward integration. This could involve establishing large-scale contract farming programs with local farmers for the cultivation of maize and, where feasible, soybean, to secure a more stable and predictable local supply.

- Unified Policy Advocacy: Companies should collaborate through the Feed Industries Association of Bangladesh (FIAB) to present a unified front in lobbying the government for targeted policies that address the industry’s specific needs. This should focus on advocating for a rationalized import duty structure for key raw materials and additives, and for the introduction of meaningful export incentives.

9.3. For Policymakers and Regulatory Bodies

- Address the Raw Material Cost Structure: Policymakers should conduct a thorough review of the import duty and tariff structure applied to essential feed raw materials (maize, soybean meal) and critical micro-ingredients (vitamins, minerals, additives). A rationalized tariff policy that reduces the cost burden on this critical input could have a significant positive impact on domestic food price stability and the industry’s overall health.

- Implement Targeted Export Incentives: To help the industry leverage its excess capacity and compete in regional markets, the government should seriously consider FIAB’s proposal for a cash incentive on feed exports. This would help to offset the high cost of imported inputs and make Bangladeshi feed more price-competitive, thereby boosting foreign currency earnings.

- Streamline Regulatory Enforcement: There is a need to streamline the regulatory landscape and enhance coordination between the key agencies (DLS, BFSA, BSTI). Creating a “single window” or a more clearly defined and coordinated enforcement mechanism would reduce complexity for businesses and create a more predictable and attractive investment environment.

- Promote R&D and Import Substitution: The government should actively support and fund research and development initiatives aimed at improving the yields of domestic maize and soybean crops. Furthermore, supporting R&D into viable local alternatives to imported protein sources could, in the long term, reduce the industry’s critical import dependency and enhance national food sovereignty. Promoting the adoption of climate-resilient crop varieties for feed ingredients should also be a priority.

Works cited

- FEED INDUSTRY IN BANGLADESH: ACHIEVING EFFICIENCY …, accessed July 22, 2025, https://idlc.com/mbr/download/2025/MBRMarch2025.pdf

- The boom of feed industry | The Business Standard, accessed July 22, 2025, https://www.tbsnews.net/supplement/boom-feed-industry-863831

- Feed Mill in Bangladesh in 2023 | Hire the most effective law firm to start your Feed Industry in BD – Tahmidur Rahman, accessed July 22, 2025, https://tahmidurrahman.com/feed-mill-in-bangladesh/

- Feed feeds Bangladesh – Policy Insights, accessed July 22, 2025, https://policyinsightsonline.com/2019/01/feed-feeds-bangladesh/

- Livestock & Fisheries – Invest Bangladesh, accessed July 22, 2025, https://investbangladesh.co/livestock-and-fisheries/

- Consumers profile analysis towards chicken, beef, mutton, fish and …, accessed July 22, 2025, https://www.researchgate.net/publication/328335204_Consumers_profile_analysis_towards_chicken_beef_mutton_fish_and_egg_consumption_in_Bangladesh

- Report Name: Grain and Feed Annual – USDA Foreign Agricultural Service, accessed July 22, 2025, https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Annual_Dhaka_Bangladesh_BG2024-0002.pdf

- Bangladesh’s aquaculture success story | The Fish Site, accessed July 22, 2025, https://thefishsite.com/articles/bangladeshs-aquaculture-success-story

- Full article: Livestock and aquaculture farming in Bangladesh: Current and future challenges and opportunities – Taylor & Francis Online, accessed July 22, 2025, https://www.tandfonline.com/doi/full/10.1080/23311932.2023.2241274

- Bangladesh: Fisheries sector becomes a key pillar of economy, contributes 3.61pc to GDP, accessed July 22, 2025, https://icsf.net/newss/bangladesh-fisheries-sector-becomes-a-key-pillar-of-economy-contributes-3-61pc-to-gdp/

- Aquaculture growth potential in Bangladesh – WAPI factsheet – FAO Knowledge Repository, accessed July 22, 2025, https://openknowledge.fao.org/server/api/core/bitstreams/96499505-908c-4b57-8633-982d7a3afe36/content

- Bangladesh aquafeed sector: Feed innovation and industry expansion, accessed July 22, 2025, https://www.aquafeed.com/newsroom/editors-picks/bangladesh-aquafeed-sector-feed-innovation-and-industry-expansion/

- Bangladesh Aquaculture Market Report Analysis 2025-2033 – IMARC Group, accessed July 22, 2025, https://www.imarcgroup.com/bangladesh-aquaculture-market

- Bangladesh Animal Feed Market- Trend Analysis & Forecasts, accessed July 22, 2025, https://www.marketresearch.com/StatLedger-Market-Research-Consulting-v4317/Bangladesh-Animal-Feed-Trend-Forecasts-41057295/

- Desh Feed Mills Ltd – PDG, accessed July 22, 2025, https://pg2011.com/desh_feed_Mills_Ltd

- FEED INDUSTRY OF BANGLADESH: – IDLC, accessed July 22, 2025, https://idlc.com/mbr/images/public/xWV4Ylp7Dg1TyTKLENXGmW.pdf

- Bangladesh Animal Feed Market Report and Forecast 2025-2034, accessed July 22, 2025, https://www.researchandmarkets.com/reports/6076999/bangladesh-animal-feed-market-report-forecast

- Understanding the Poultry Feed Market in Bangladesh: Costs and Top Suppliers – akijfeed.com, accessed July 22, 2025, https://akijfeed.com/poultry-feed-market-in-bangladesh/

- Feed prices stay high despite drop in global markets – The Daily Star, accessed July 22, 2025, https://www.thedailystar.net/business/economy/news/feed-prices-stay-high-despite-drop-global-markets-3792001

- Feed Mill Industry in Bangladesh: A Recent Survey in 2018 | PPTX – SlideShare, accessed July 22, 2025, https://www.slideshare.net/slideshow/feed-mill-industry-in-bangladesh-a-recent-survey-in-2018/164867820

- Home | Paragon Group, accessed July 22, 2025, https://www.paragongroup-bd.com/business/feed-mills

- Quality Feeds Limted (QFL) – Top Animal Feed Manufacturing …, accessed July 22, 2025, https://qfl.com.bd/

- List of Major Feed Companies in Bangladesh and Their Contact Details | PDF | Dhaka, accessed July 22, 2025, https://www.scribd.com/doc/125108636/List-of-Major-Feed-Companies-in-Bangladesh-and-their-contact-details

- National Feed Mill Ltd. | nationalmills – National Group, accessed July 22, 2025, https://www.nationalgroup-bd.com/national-feed-mills

- Bangladesh Poultry Sector: Efficiency & Growth Opportunities – LightCastle Partners, accessed July 22, 2025, https://lightcastlepartners.com/insights/2024/08/bangladesh-poultry-sector-efficiency-inclusivity-growth/

- About Us – FIAB – Feed Industries Association Bangladesh, accessed July 22, 2025, https://fiab.org.bd/about-us/

- FIAB – Feed Industries Association Bangladesh – FIAB – Feed Industries Association Bangladesh, accessed July 22, 2025, https://fiab.org.bd/

- Mission – FIAB – Feed Industries Association Bangladesh, accessed July 22, 2025, https://fiab.org.bd/mission/

- Poultry, fish feed producers seek cash incentive – Finance News …, accessed July 22, 2025, https://today.thefinancialexpress.com.bd/metro-news/poultry-fish-feed-producers-seek-cash-incentive-1680369305

- Founder President & Secretary General Message – BAFIITA, accessed July 22, 2025, https://www.bafiita.org.bd/pages/2/about-message

- Bangladesh should enhance standards to open poultry export opportunities – aviNews, accessed July 22, 2025, https://avinews.com/en/bangladesh-should-enhance-standards-to-open-poultry-export-opportunities/

- (PDF) Modelling the Demand for Meat in Bangladesh – ResearchGate, accessed July 22, 2025, https://www.researchgate.net/publication/343803306_Modelling_the_Demand_for_Meat_in_Bangladesh

- Consumers’ willingness to pay for safer fish: Evidence from experimental auctions in Bangladesh – Purdue Agriculture, accessed July 22, 2025, https://ag.purdue.edu/food-safety-innovation-lab/wp-content/uploads/2024/06/Consumers_WTP_safer_fish-_508_remediated_Final.pdf

- Consumers struggle with inflation in Dhaka kitchen markets | The Business Standard, accessed July 22, 2025, https://www.tbsnews.net/economy/bazaar/consumers-struggle-inflation-dhaka-kitchen-markets-853541

- Van Aarsen: For Leaders in High-Quality Feed Production, accessed July 22, 2025, https://vanaarsen.com/

- Feed Mill Automation – Sterling Systems & Controls, accessed July 22, 2025, https://sterlingcontrols.com/products-capabilities/complete-systems/feed-mill-automation/

- Feed & Agro – alphatek.com.bd, accessed July 22, 2025, https://alphatek.com.bd/en/page/feed-agro

- Latest feed milling technology in the world, accessed July 22, 2025, https://gfmdhaka.com/news/latest-feed-milling-technology-in-the-world

- Report Name:Bangladesh Animal Feed Rules 2013, accessed July 22, 2025, https://dghs.portal.gov.bd/sites/default/files/files/dghs.portal.gov.bd/page/590ba637_9dca_49f8_bfb7_65c6f2f4bba0/2025-04-10-05-40-105cc8883b0b03c77b489ebad3d6dda2.pdf

- Bangladesh Food Safety Authority Ministry of Food, Govt. of Bangladesh Dhaka, accessed July 22, 2025, https://bangladeshbiosafety.org/wp-content/uploads/2021/03/BFSA-Strategy-for-Harmoniztion-of-Standards-draft-V-1.pdf

- Specification For Poultry Feed | PDF | Animal Feed | Calorie – Scribd, accessed July 22, 2025, https://www.scribd.com/document/388171621/Specification-for-Poultry-Feed

- LIST OF BANGLADESH STANDARDS ON AGRICUTURAL AND FOOD PRODUCTS, accessed July 22, 2025, https://bsti.portal.gov.bd/sites/default/files/files/bsti.portal.gov.bd/page/b5ede8e7_aff6_4651_82a4_94ee498ca073/2023-09-18-09-26-0e35f0f2bf128768a20ba43700b79dda.pdf

- Bangladesh -Standards for Trade – International Trade Administration, accessed July 22, 2025, https://www.trade.gov/country-commercial-guides/bangladesh-standards-trade

- Act & Law – FIAB – Feed Industries Association Bangladesh, accessed July 22, 2025, https://fiab.org.bd/act-law/

- Bangladesh Food and Agricultural Import Regulations and Standards Report FAIRS Annual Country Report – APEDA- Agri Exchange, accessed July 22, 2025, https://agriexchange.apeda.gov.in/ImportRegulations/FoodandAgriculturalImportRegulationsandStandardsReportDhakaBangladesh4152019.pdf

- Food and Agricultural Import Regulations and Standards Country Report, accessed July 22, 2025, https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Food%20and%20Agricultural%20Import%20Regulations%20and%20Standards%20Country%20Report_Dhaka_Bangladesh_06-30-2021.pdf

- Bangladesh Food and Agricultural Import Regulations and Standards Report FAIRS Annual Country Report, accessed July 22, 2025, https://apps.fas.usda.gov/newgainapi/api/report/downloadreportbyfilename?filename=Food%20and%20Agricultural%20Import%20Regulations%20and%20Standards%20Report_Dhaka_Bangladesh_4-15-2019.pdf

- Agriculture sector gets TK 17,000 cr subsidy in proposed national …, accessed July 22, 2025, https://www.bssnews.net/national-budget-2025-2026/279500

- Bangladesh: Cash incentives to fisheries, livestock farmers launched | Salaam Gateway, accessed July 22, 2025, https://beta.salaamgateway.com/story/bangladesh-cash-incentives-to-fisheries-livestock-farmers-launched

- Bangladesh Animal Feed Market- Trend Analysis & Forecast to 2030 – StatLedger, accessed July 22, 2025, https://statledger.com/products/bangladesh-animal-feed-market-trend-analysis-forecast-to-2030

- Bangladesh Animal Feed Industry Outlook 2024 – 2028 – ReportLinker, accessed July 22, 2025, https://www.reportlinker.com/clp/country/523474/726290